LEDVANCE is set up by Osram, the world's second largest lighting products and solutions provider, to take over the general lighting business and will undertake the OSRAM general lighting business. In a reply to the Shenzhen Stock Exchange's inquiry letter, Mulinsen mentioned that the overall gross profit margin of LEDVANCE remained above 20% during the reporting period. Due to the transformation of business strategy, a large amount of Mulinsen announced on the evening of May 1 that on April 13, 2017, the company received the “Response to the Reorganization of Mulinsen Co., Ltd.†issued by the Management Department of the SME Board of the Shenzhen Stock Exchange. Letter, according to the requirements of the "Inquiry Letter", the company and the intermediary agencies have implemented the item-by-item and written reply on the issues involved in the "Inquiry Letter". After applying to the Shenzhen Stock Exchange, the company's stock will be on May 2, 2017 ( Tuesday resumed trading on the market. According to the restructuring plan, the company intends to acquire a 100% equity interest in Mingxin Optoelectronics held by Harmony Mingxin and Zhuo Rui Investment by way of issuing shares and paying cash to purchase assets and raising matching funds. Among them, Harmony Mingxin's shareholding ratio is 99.99%, and Zhuo Rui Investment's shareholding ratio is 0.1%. According to public information, Mingxin Optoelectronics' main asset is 100% equity of LEDVANCE. According to Mulinsen’s previous announcement, the main body of the acquisition of LEDVANCE is Harmony Mingxin (Yiwu) Optoelectronics Technology Co., Ltd. (ie Mingxin Optoelectronics), a subsidiary of Harmony Mingxin Limited Partner (ie Harmony Mingxin). Harmony Mingxin is composed of IDG Capital, Mulinsen and Yiwu State-owned Assets Operation Center. On March 3 this year, Mingxin Optoelectronics and LEDVANCE GmbH's original shareholder OSRAM GmbH and LEDVANCE LLC's original shareholder OSRAM SYLVANIA INC. officially completed the equity transfer of the transaction. At this point, Mingxin Optoelectronics holds a 100% stake in LEDVANCE and has successfully completed the overseas equity acquisition of LEDVANC. After the completion of this transaction, Mulinsen will hold 100% equity of Mingxin Optoelectronics, Mingxin Optoelectronics will become a wholly-owned subsidiary of Mulinsen. LEDVANCE is set up by Osram, the world's second largest lighting products and solutions provider, to take over the general lighting business and will undertake the OSRAM general lighting business. In a reply to the Shenzhen Stock Exchange's inquiry letter, Mulinsen mentioned that the overall gross profit margin of LEDVANCE remained above 20% during the reporting period. Due to the transformation of business strategy, a large amount of restructuring related expenses occurred, but LEDVANCE's profitability after deducting restructuring related expenses was good. Finally resumed trading! Mulinsen responded to the acquisition of Mingxin Optoelectronics. Mulinsen also responded to the Shenzhen Stock Exchange on the profitability of LEDVANCE, the ability to operate independently, the implementation of relevant plans, and the approval of government agencies. Mulinsen said that the company's core strengths are strong manufacturing capabilities and superior cost control. The main advantages of LEDVANCE are in supply chain management, quality control, brand and channel resources. After the completion of the transaction, Mulinsen and LEDVANCE will complement each other in the production of LED lighting products. Prior to this transaction, LEDVANCE has not purchased LED package products and accessories from Mulinsen. After the completion of this transaction, some of the LED packaging products and accessories required for LEDVANCE's lighting products can be supplied directly or indirectly by Mulinsen, thereby increasing the sales of Mulinsen LED packaging products and accessories and driving the growth of listed companies' profits. After the completion of the transaction, the synergy effect of Mulinsen and LEDVANCE in manufacturing is mainly reflected in the increase in sales of listed LED packaging products and the increase in sales revenue of PCB circuit boards and power drives. It is reported that Mulinsen’s transaction is supplemented by cash payment and share-based payment. Among them, it is proposed to pay 31.35% of the consideration of Mingxin Optoelectronics in cash, not exceeding 1.254 billion yuan; 68.65% of the consideration of Mingxin Optoelectronics will be paid by way of issuing shares, not exceeding 2.746 billion yuan, and the total number of issued shares shall not exceed 9624.9 Ten thousand shares. In addition, Mulinsen also plans to raise 1.255 billion yuan from the non-public offering of shares of no more than 10 specific investors for the Yiwu LED lighting application product project and pay for the restructuring related expenses. After the completion of the transaction, Sun Qinghuan is still the actual controller of Mulinsen. It is worth mentioning that Mulinsen previously held a 31.242% share of Harmony Mingxin as a limited partner of Harmony Mingxin. Therefore, in order to avoid the indirect cyclical holdings of this restructuring transaction, the cash consideration in the transaction price will be mainly used for the withdrawal of Mu Linsen, the source of funds is Mu Linsen's own funds or self-raised funds. According to Mulinsen’s previous introduction, after the completion of the cash consideration payment, all parties should jointly arrange for the listed company to withdraw from Harmony Mingxin, and return it to the company by Harmony Mingxin in accordance with the terms of the partnership agreement after the settlement of the clear core in Mulinsen. Core property share. After the completion of the withdrawal procedure, Mulinsen will register the new shares acquired by Harmony Mingxin. However, as of now, the price of Mingxin Optoelectronics' acquisition of the target company's equity has not yet been finalized. According to the best estimate provided by LEDVANCE on the diplomatic cut-off date, the initial price of LEDVANCE 100% equity diplomatic cut is 485.7 million euros.

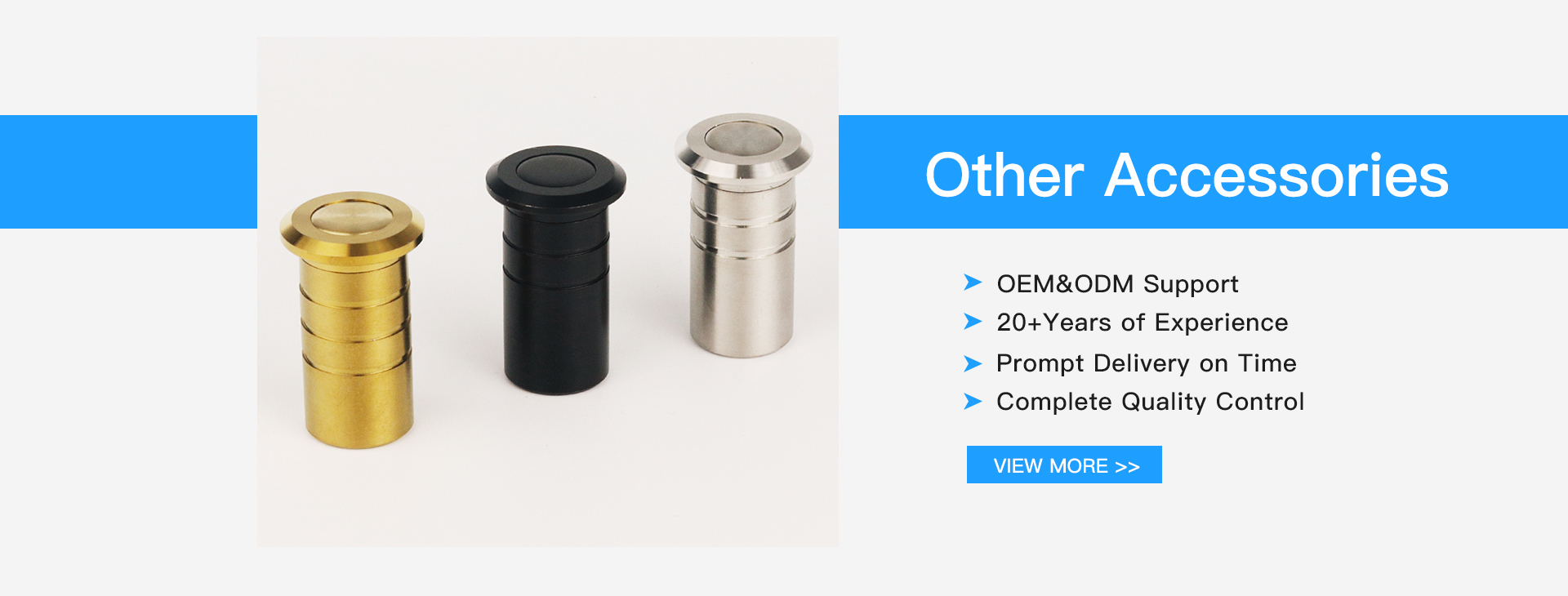

Other Accessories,Popular Shower Door Handle,Stainless Steel Dust Proof,Black Glass Door Knobs

ONLEE HARDWARE CO.,LTD , https://www.onleehardware.com