As we all know, subsidy is the main thrust of the development of China's new energy auto industry. However, as subsidies for new energy vehicles begin to decline this year, the entire industry has been affected to varying degrees. From the announcement of the 2017 semi-annual performance announcement released by several automobile companies, it was learned that the new energy vehicle company's performance in the first half of the year did not meet market expectations compared with the same period of last year.

Foton Motor:

The forecast of Foton Motor's performance shows that after the financial department again estimated that in the second quarter of the company, it has confirmed the 415 million yuan (190 million yuan in cash and 275 million yuan in equity) related to Pride’s share transfer equity gains. The net profit of listed company shareholders will be reduced by about 30% compared with the same period of last year, and the net profit attributable to shareholders of listed companies is 146,833,355 yuan.

For the reasons for the decline in performance, Foton Motor stated:

1. Affected by the adjustment of new energy policies and the announcement of the 30,000-kilometer new energy policy, the sales of pure electric vehicles of the company did not reach expectations, and actual sales volume in the second quarter was lower than the original forecast, affecting overall profits;

2. Some businesses are affected by the intensification of market competition, sales volume has not reached expectations, and factory production location adjustments have resulted in a large increase in cost costs, which has temporarily affected overall profits.

3. The new business is currently in the period of market cultivation. In the second quarter, when the market sales did not reach the expected business, it will have an impact on the company's profits.

4. Affected by the fluctuation of raw materials in the first half of the year, increasing the company's procurement costs, and thus affecting the company's profits;

5. The adjustment of the corporate income tax expense by the final settlement and payment will have a certain impact on the company's current net profit.

Seahorse Motors:

The forecast of Haima Motor's performance shows that the net profit attributable to the shareholders of the listed company is about 10 to 50 million yuan, which is about 70% to 95% lower than the same period of last year.

Haima Motor Co., Ltd. said that due to the company's car sales fell sharply year-on-year, resulting in a substantial decline in performance.

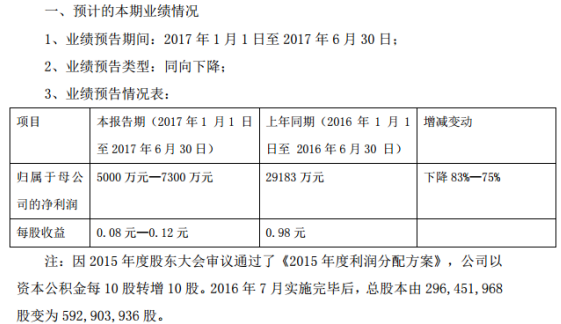

Zhongtong Bus:

Zhongtong Bus's performance forecast shows that from January to June 2017, the net profit is expected to be 50 million to 73 million yuan, down 83.00% to 75.00% year-on-year.

Zhongtong Bus stated that the above predictions are based on the following reasons: In 2017, the national new energy passenger vehicle subsidy standard drastically decreased. Affected by this policy, the passenger car industry experienced a sharp decline, and the company’s orders in the first quarter decreased accordingly, resulting in the company’s number one in 2017. Quarterly operating performance dropped significantly year-on-year.

Ankai Bus:

Ankai is expected to lose 24 million yuan to 32 million yuan in net profit attributable to shareholders of listed companies during the first half of this year.

Kaike said that the reason for the expected performance loss in the current period was mainly because the passenger car market was significantly affected by the industry policy and the overall decline was obvious. The sales scale of the company decreased; the change in sales product structure led to a lower gross profit margin; affected by the national new energy subsidy policy, the company Bank liabilities increased, and financial expenses increased significantly from the same period of last year.

FAW Car:

FAW Car's announcement showed that FAW sedan sales rose by 37.8% year-on-year, and at the same time it achieved profitability in the first half of the year. It is estimated that net profit for the first half of the year will be 270 million to 330 million yuan.

FAW Car said that in the first half of 2017, the company achieved sales of 111,200 vehicles, an increase of 37.83% over the same period of last year. During the reporting period, the company actively promoted the implementation of various business measures. By speeding up the launch of new products, it successfully launched the new Pentium X40, optimized its product layout, and improved its marketing capabilities. It strived to improve the quality and effectiveness of its operations, and its operating results turned losses into profits.

Based on the above five companies, OFweek New Energy Automotive Network has compiled statistics on its data.

Car price semi-annual performance list

From the above table, it can be seen that the net profit income of FAW Car and Foton Motor in the first half of the year was the highest, which was 27,000 to 33,000 yuan and 148.833 million yuan respectively; the net profit income of Zhongtong bus and hippocampal automobile lagged slightly behind, which was 5 to 73 million yuan respectively. Yuan and 1,000 to 50 million yuan; and Ankai passenger car net profit loss.

Although the new energy automotive industry is facing policy adjustments such as subsidy retreats, sales in the first half of the year are not ideal, but this is also a negative response to the short-term and is a natural reaction of the market. It is believed that as the industry gradually adapts to policies, The majority of consumers are increasingly accepting that the new energy auto industry will pick up in the second half of the year.

EKS-SP High Speed Injection Machine

Eks-Sp High Speed Iinj Mach,High Speed Injection Moulding Machine,Fast Injection Mouding Machine,Servo Injection Molding Machine

Ningbo Jietan Machinery Equipment Trading Co., Ltd. , https://www.jietanmachine.com